I have mentioned ad nauseam that I am a big fan of +Smartsheet and use it to track all of my daily tasks and projects. I have discovered the power of adding a budget column to my tasks sheet. Stuff that relates to me, personally, has one big sheet that gets subdivided into sections and subsections for every aspect of being Shaine Lee Mata. Currently, it's a list with over 900 items. I agree with you that I have way too many items listed.

I imagine that one could either give up on ever getting around to 900 items, or truly put everything into making a dent in the list. Yet, it seems that I am perpetually removing items that are done and adding some back. There are items that never seem to come off the list. They do eventually, but it seems like they never do.

I wondered why some items were lingering more than others. Obviously, it's because I never got around to doing them; but, what was holding me back. So, I went down the list and asked myself what was stopping me from doing each one. Too often, for those particularly recalcitrant to-do items, it turns out that it was lack of money. Often, these items have a cost that I am, have been unwilling to incur at the time.

For example, if I need haircuts for my son and for me, I know it will cost me about $30. But, if I'm a bit tight on cash this week, I would schedule the shearing for the following week after pay day. Or, if I need to buy new tires, upgrades for the computer, a tool, or whatever. It makes sense to cluster these things around when I have money, and when I see the cluster is too big, move it to the next payday.

As it turns out, having a budget cell next to my to-do item helps relieve some of that "guilt" about not getting around to doing it. In fact, I will know I have a damned good reason for not doing it. I can see at a glance that the new SSD for my computer costs $125, and is not as essential as, let's say, $30 in groceries. When I have $125 to spare, then it enters my realm of possibilities. If you have a big spend coming up, it doesn't make sense to put other big spends on the calendar around that time.

But, the budget field doesn't only apply to financial costs. There are also time costs. There are some tasks that do not cost you any cash, in some measurable way. However, those tasks may cost you time, which is also a limited supply. If I know that something will take me 2 hours to do, I may hesitate to schedule it during busy days unless absolutely necessary.

Doing three 15-minute tasks is more feasible than doing one 2 or 3 hour task. Or, let's say that I'm feeling particularly smurfy and decide to take on those 2 hour tasks in the evenings after work. This means that I would only schedule the one item for that evening rather than try to fill every nook and cranny of my evening.

When it comes down to it, adding a budget to your tasks, whether a financial or temporal budget, forces you to make your choices based on priorities. Your priorities may change from day to day, or week to week; but, the budget gives you an objective measure for choosing to do or not do something. And with that, you can rest peacefully with the knowledge that those items remaining on the list are better for you than trying to kick them out ASAP while making you broke or time-starved.

Shaine Mata's personal blog. Working towards my goals. Seeing life, living it, and sharing it.

Thursday, October 23, 2014

Wednesday, October 15, 2014

Sad To Leave Slack, A Great Product

A few weeks ago, I read an article about Slack, a marvelous business tool that is useful for team communications and project information gathering. Slack has been a hit among knowledge workers, particularly people who manage online services. I signed up for the free trial and was blown away. However, despite my deep respect for the product, I'm going to have to walk away from it.

The issue is not with Slack itself. I think Slack is the victim of the "network effect" to some extent, or the reverse of it, rather. I don't have a network on Slack. Therefore, it is a really cool way to organize project information and data streams. However, I already have invested into +Evernote and +Smartsheet.

While I do not have networks on those products either, they are rather powerful without the network. And so, I find that the ability to create streams of information rather than a giant pile of...email is a great idea. Slack makes sense in so many ways.

I have written in the past that my problem with Evernote is that I do NOT need to remember everything, thus I engage in active deleting of information. Some information is more valuable if it doesn't get in your way. So, I've slowly started to segregate information into archives, working spaces, and stuff that can and should be deleted.

With the help of +IFTTT, I am crudely reproducing some of the great Integrations provided by Slack. RSS feeds and tweets are appended to Evernote notes, which I can periodically delete or archive. Having used Slack for the last few weeks, I have learned a new way to sort information into Evernote that makes it, once again, a great product for managing my everyday needs.

Smartsheet comes into the equation because it is great for organizing work, and then I can dip into Evernote and Google Drive to attach working documents.

Standing back from it all, Evernote catches information and Smartsheet organizes it for action. This way, information doesn't get in the way of doing.

The issue is not with Slack itself. I think Slack is the victim of the "network effect" to some extent, or the reverse of it, rather. I don't have a network on Slack. Therefore, it is a really cool way to organize project information and data streams. However, I already have invested into +Evernote and +Smartsheet.

While I do not have networks on those products either, they are rather powerful without the network. And so, I find that the ability to create streams of information rather than a giant pile of...email is a great idea. Slack makes sense in so many ways.

I have written in the past that my problem with Evernote is that I do NOT need to remember everything, thus I engage in active deleting of information. Some information is more valuable if it doesn't get in your way. So, I've slowly started to segregate information into archives, working spaces, and stuff that can and should be deleted.

With the help of +IFTTT, I am crudely reproducing some of the great Integrations provided by Slack. RSS feeds and tweets are appended to Evernote notes, which I can periodically delete or archive. Having used Slack for the last few weeks, I have learned a new way to sort information into Evernote that makes it, once again, a great product for managing my everyday needs.

Smartsheet comes into the equation because it is great for organizing work, and then I can dip into Evernote and Google Drive to attach working documents.

Standing back from it all, Evernote catches information and Smartsheet organizes it for action. This way, information doesn't get in the way of doing.

Tuesday, October 14, 2014

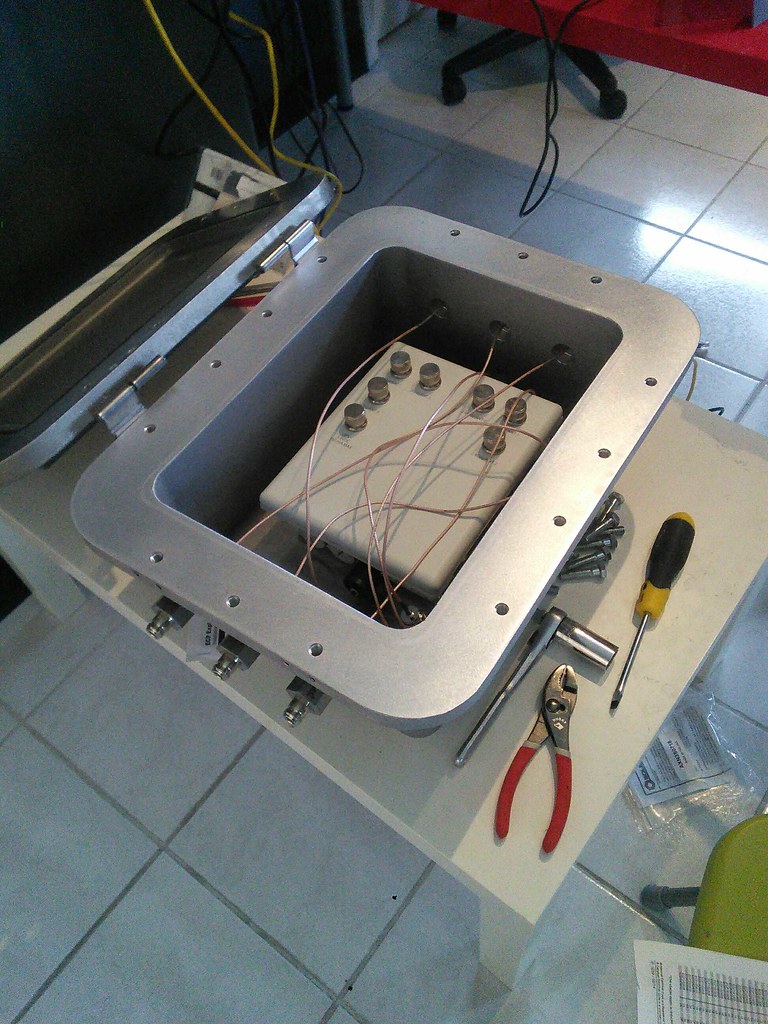

October 09, 2014 at 11:58AM - Shaine Mata on Flickr

Take a look http://ift.tt/1yyMSEY

Sunday, October 12, 2014

The Problems I Have With Bitcoin

I have some problems with Bitcoin that cause me some concern for its long-term usage. These concerns are not about the immediate viability of the cryptocurrency. For now, I think Bitcoin is the right innovation for the modern world. However, there are some shortcomings that concern me.

If you lose your wallet information, let's say your dog ate the paper on which you wrote your keys, or maybe he ate your hard drive, then you have no way of accessing that lost Bitcoin, nor anybody else for that matter. This means that they are stuck on the ledger forever, never to be traded again.

With a few million Bitcoin in circulation, this doesn't sound like a big deal, a few Bitcoin here and there. However, over time, these lost Bitcoins can add up, reducing the overall availability of Bitcoin for use. Things seem to be working more or less OK for the moment, but, if the ultimate goal is to get all 8 Billion people on Earth using Bitcoin for commerce, there already aren't enough. So, we are doomed to deal in smaller and smaller fractions of Bitcoin as they get hoarded and/or lost over time. It's going to get ridiculous when you are paying 0.000005121 for a cup of coffee.

Speaking of hoarding, that's another problem. One of the reasons why we have a Federal Reserve is that there wasn't enough gold to go around. If you have a mortgage on your farm to pay, you need people to buy your crops. If there is not enough cash in circulation, then your customers don't have the cash to pay you. The problem we had with gold was bank runs. There wasn't enough gold at banks to satisfy depositors' claims. Therefore, there wasn't enough money for people to use to pay their debts. It may have been their money on accounting ledgers, but there wasn't enough cash for them to pull from A to put into B. Silver was added to the money supply, but even that was eventually abandoned.

With Bitcoin, we do not have to worry so much about bank runs as there is no bank; but, hoarding can be problematic. Let us say that you somehow end up with 1 million Bitcoin, through savvy trades and good, ethical business practices. That leaves fewer Bitcoin in the pool, which is non-inflationary. Because you control so many coins, the price for Bitcoin goes up because there are fewer around for transactions. So, as the price goes up, your Bitcoin hoarding starts to pay off in higher valuations. You just have to sit on it and watch the value go up. What is your incentive to trade? It warps the value of Bitcoin.

With gold, we had some increase in the supply. Even today, several hundred tons of gold are mined each year throughout the world. So, the present supply of gold is limited, but, does slowly increase over time. With Bitcoin, there is an increase in the supply, up until the the 21 million Bitcoin limit. After that, the only way to provide access to the 21 million bitcoin to all the billions of people on earth is to use fractional reserve banking. Without that, we face deflation.

There are arguments in favor of deflation, but most Economists are trained in inflationary economies and wouldn't know how to deal in a world where deflation is the norm. This is why we have spent trillions of dollars propping up the stock market. Not only are Economists ill-equipped to reimagine the world in a deflationary economy, the public is completely unable to deal with the prospect of decreasing salaries and values for the goods they want to sell, even though they would be just as well served in the long run.

For the moment, we are spared some of the problem with Bitcoin deflation thanks to mining introducing new Bitcoins intothe system.

The Bitcoin blockchain is around 9 GB at this time. This is with a few million geeks occasionally transacting back and forth among themselves. What happens when you scale Bitcoin to 8 billion users making several transactions per day? How large can the blockchain grow? What happens when it reaches 1 TB? 10 TB? Presumably, storage is getting cheaper (deflation) and processing is getting more powerful. But, still, there are practical considerations to keep in mind when pushing and pulling that much data around. Imagine trying to launch a node when the blockchain reaches 1 TB; how long would that take to synchronize?

What do we do with the blockchain in 50 years? 100 years? We are going to require centralized machines to handle transactions because participation will be out of reach for the average user. We are already seeing this with mining pools. You as an individual have little opportunity to successfully mine Bitcoin compared to the big players. Things will only become more competitive as the Bitcoin mining reward gets smaller and smaller and the necessary resources for mining increase in computing demand.

As stated at the opening, I am a fan of Bitcoin. I like what it does. However, I have some reservations about its long-term viability. Specifically, what concerns me is the fixed Bitcoin supply, which is impacted by lost Bitcoins and some of the same problems gold faces as a currency, namely hoarding. However, even gold has some degree of inflation as it continues to be mined.

I think that cryptocurrencies should include some degree of inflation to make up for coin loss and to counter some of the problems with deflation. For this reason, I like NXT and Blackcoin because they employ "minting" to slowly and predictably introduce new currency. I think 1% is too low, because people breed faster than that; but, it's a move in the right direction.

Bitcoin may be a bridge that takes us to the next level of cryptocurrency. I think it is a great start; but, we should be looking for a next generation option.

Lost Bitcoins

If you lose your wallet information, let's say your dog ate the paper on which you wrote your keys, or maybe he ate your hard drive, then you have no way of accessing that lost Bitcoin, nor anybody else for that matter. This means that they are stuck on the ledger forever, never to be traded again.

With a few million Bitcoin in circulation, this doesn't sound like a big deal, a few Bitcoin here and there. However, over time, these lost Bitcoins can add up, reducing the overall availability of Bitcoin for use. Things seem to be working more or less OK for the moment, but, if the ultimate goal is to get all 8 Billion people on Earth using Bitcoin for commerce, there already aren't enough. So, we are doomed to deal in smaller and smaller fractions of Bitcoin as they get hoarded and/or lost over time. It's going to get ridiculous when you are paying 0.000005121 for a cup of coffee.

Fixed Bitcoin Supply

Speaking of hoarding, that's another problem. One of the reasons why we have a Federal Reserve is that there wasn't enough gold to go around. If you have a mortgage on your farm to pay, you need people to buy your crops. If there is not enough cash in circulation, then your customers don't have the cash to pay you. The problem we had with gold was bank runs. There wasn't enough gold at banks to satisfy depositors' claims. Therefore, there wasn't enough money for people to use to pay their debts. It may have been their money on accounting ledgers, but there wasn't enough cash for them to pull from A to put into B. Silver was added to the money supply, but even that was eventually abandoned.

With Bitcoin, we do not have to worry so much about bank runs as there is no bank; but, hoarding can be problematic. Let us say that you somehow end up with 1 million Bitcoin, through savvy trades and good, ethical business practices. That leaves fewer Bitcoin in the pool, which is non-inflationary. Because you control so many coins, the price for Bitcoin goes up because there are fewer around for transactions. So, as the price goes up, your Bitcoin hoarding starts to pay off in higher valuations. You just have to sit on it and watch the value go up. What is your incentive to trade? It warps the value of Bitcoin.

With gold, we had some increase in the supply. Even today, several hundred tons of gold are mined each year throughout the world. So, the present supply of gold is limited, but, does slowly increase over time. With Bitcoin, there is an increase in the supply, up until the the 21 million Bitcoin limit. After that, the only way to provide access to the 21 million bitcoin to all the billions of people on earth is to use fractional reserve banking. Without that, we face deflation.

There are arguments in favor of deflation, but most Economists are trained in inflationary economies and wouldn't know how to deal in a world where deflation is the norm. This is why we have spent trillions of dollars propping up the stock market. Not only are Economists ill-equipped to reimagine the world in a deflationary economy, the public is completely unable to deal with the prospect of decreasing salaries and values for the goods they want to sell, even though they would be just as well served in the long run.

For the moment, we are spared some of the problem with Bitcoin deflation thanks to mining introducing new Bitcoins intothe system.

The Blockchain Size

The Bitcoin blockchain is around 9 GB at this time. This is with a few million geeks occasionally transacting back and forth among themselves. What happens when you scale Bitcoin to 8 billion users making several transactions per day? How large can the blockchain grow? What happens when it reaches 1 TB? 10 TB? Presumably, storage is getting cheaper (deflation) and processing is getting more powerful. But, still, there are practical considerations to keep in mind when pushing and pulling that much data around. Imagine trying to launch a node when the blockchain reaches 1 TB; how long would that take to synchronize?

What do we do with the blockchain in 50 years? 100 years? We are going to require centralized machines to handle transactions because participation will be out of reach for the average user. We are already seeing this with mining pools. You as an individual have little opportunity to successfully mine Bitcoin compared to the big players. Things will only become more competitive as the Bitcoin mining reward gets smaller and smaller and the necessary resources for mining increase in computing demand.

Conclusion

As stated at the opening, I am a fan of Bitcoin. I like what it does. However, I have some reservations about its long-term viability. Specifically, what concerns me is the fixed Bitcoin supply, which is impacted by lost Bitcoins and some of the same problems gold faces as a currency, namely hoarding. However, even gold has some degree of inflation as it continues to be mined.

I think that cryptocurrencies should include some degree of inflation to make up for coin loss and to counter some of the problems with deflation. For this reason, I like NXT and Blackcoin because they employ "minting" to slowly and predictably introduce new currency. I think 1% is too low, because people breed faster than that; but, it's a move in the right direction.

Bitcoin may be a bridge that takes us to the next level of cryptocurrency. I think it is a great start; but, we should be looking for a next generation option.

Saturday, October 11, 2014

The IRS Considers Bitcoin Property, Not Currency: What It Means

Reading through the IRS Guidance on Bitcoin, it states that the IRS considers Bitcoin as personal property. So, if you, for example, buy a car for $1000 and sell it for $3000 after some minor repairs, the value added is considered income by the IRS and is taxable. Similarly, if you buy Bitcoin at $320 and sell it for $340, you pay taxes on the $20 profit.

This is very similar to stocks, with the exception that you buy whole units of stocks, generally. You can take a loss or make a capital gain. The way you track this is by keeping records of how much you paid for the stock and for how much you sold it, typically using a FIFO (First In, First Out) basis. With stocks, you sell whole units as well. Tracking your stocks only gets ornery when you buy a stock on a recurring basis. With stocks, you also add transaction fees and commissions into your cost.

With Bitcoin, accounting is pretty much the same, except that the arithmetic gets complicated because we do not deal with whole units of Bitcoin on the purchase or the sale.

The best way to think of it is that when somebody pays you in Bitcoin, they are paying you with a non-dividend paying stock that you can redeem somewhere else. Between receiving the Bitcoin and paying it out, you may earn money or lose money. I've seen the value of my meager Bitcoin holdings appreciate and depreciate from day to day.

The complication with Bitcoin is that we do not generally receive whole units of bitcoin. They are always fractional units, which complicate the arithmetic. In addition, when we also do not spend whole units of Bitcoin, we spend fractional amounts. Therefore, matching up your incoming coin against several transactions of lesser coin can be tedious.

About the only blessing is that, like FOREX, commission costs are built into the price of your trades.

I'm still not 100% clear on the IRS guidance on Bitcoin because I don't deal with the some of the other conditions mentioned.

Overall, I think you may want to go light on using Bitcoin for day to day transactions, like buying a cup of coffee every morning. The accounting headache might be greater than the coolness factor, at least until software comes along to help you manage these things. In the meantime, your spreadsheet of choice will be the only means of tracking your transactions.

This is very similar to stocks, with the exception that you buy whole units of stocks, generally. You can take a loss or make a capital gain. The way you track this is by keeping records of how much you paid for the stock and for how much you sold it, typically using a FIFO (First In, First Out) basis. With stocks, you sell whole units as well. Tracking your stocks only gets ornery when you buy a stock on a recurring basis. With stocks, you also add transaction fees and commissions into your cost.

With Bitcoin, accounting is pretty much the same, except that the arithmetic gets complicated because we do not deal with whole units of Bitcoin on the purchase or the sale.

The best way to think of it is that when somebody pays you in Bitcoin, they are paying you with a non-dividend paying stock that you can redeem somewhere else. Between receiving the Bitcoin and paying it out, you may earn money or lose money. I've seen the value of my meager Bitcoin holdings appreciate and depreciate from day to day.

The complication with Bitcoin is that we do not generally receive whole units of bitcoin. They are always fractional units, which complicate the arithmetic. In addition, when we also do not spend whole units of Bitcoin, we spend fractional amounts. Therefore, matching up your incoming coin against several transactions of lesser coin can be tedious.

About the only blessing is that, like FOREX, commission costs are built into the price of your trades.

I'm still not 100% clear on the IRS guidance on Bitcoin because I don't deal with the some of the other conditions mentioned.

Overall, I think you may want to go light on using Bitcoin for day to day transactions, like buying a cup of coffee every morning. The accounting headache might be greater than the coolness factor, at least until software comes along to help you manage these things. In the meantime, your spreadsheet of choice will be the only means of tracking your transactions.

Thursday, October 09, 2014

Dealing With My Retirement Rollover

I've paid a price for consolidating my retirement accounts. I had a traditional IRA to which I sporadically contributed since age 20. It wasn't a lot of money, but it was something. In addition, having worked for the State of Texas, I had 401k and 401a accounts which were out of my control as a non-state employee. I decided to roll them together into one account at a local Edward Jones office.

So, I've slowly been turning my rolled over money into stock positions. The funny thing is that we have been expecting a market correction. So, I decided to slowly put my money into positions rather than all at once. Of course, as soon as most of my money is alloted, the market takes a crap.

I have positions in BBL, BP, DEM, GLD, HCN, HSBC, KO, RIG, and T in the IRA. I bought most of that in the past couple months as the market was reaching its peaks. Sensing that a market correction is imminent, I added GLD to my portfolio so that I don't freak out so much. It has indeed gone up on days that the market takes a dive. However, GLD has overall gone down slowly as the market gently descends.

In other words, I find that GLD is great for market freakouts; but, it's not doing so hot when the market slowly declines. In any case, GLD is in the green today, but in the red overall. Still, it brings me peace in these troubled times.

Today, I allocated the last of my retirement money into RIG, which has had their ass handed to them. As it kept dipping, I kept getting more and more excited. Sure, oil prices are low and production is still working hard. But, it's not like an oil company is going to stop exploring all of the sudden. They may not start new wells. But, they definitely won't stop midway and come back to it later. So, I figure, RIG is a great buy, long-term. I'm down over 10 percent since my first purchase. So, I bought more.

I wish I had more money to put into BBL, another stock that having its day of reckoning. They are down more than 12 percent since my purchase. Ouch. BBL is one of the better mining companies around. If I could afford more, I'd buy it now for the fat dividends in the long-run.

I bought BP because they are a good company that is having government issues. Despite the leeches, they have been making a profit and paying dividends. I think once they are done with the legal stuff, they will be more profitable. So, for me, they have been a depressed stock that will pay off long-term.

DEM invests in dividend paying companies in emerging markets. I know that the fund is somewhat risky; but, only developing markets have the growth potential to ...yes, I'll say it again, pay fat dividends. Imagine the dividend growth rate for 20+ years from now when I am forced to cash out.

HCN was a tough call. I like REITS. I know that healthcare will be a giant industry as baby boomers start to become decrepit. My Edward Jones advisor suggested HCN, and I checked them out, liked the dividends. They actually hold their value well when the market takes a crap. I think investors sell the growth stocks and pile into value, which helps HCN go up while the rest are going down. I think HCN will also help me avoid future freakouts. In the future, however, as my contributions allow, I will probably add O to my portfolio. O is a REIT that pays monthly. I certainly support a stock with that degree of confidence.

I bought HSBC purely for exposure to the financial sector. HSBC has been crawling out of their troubles and may finally be able to put their bad history behind them. More importantly, HSBC is an international concern, which means that they have better access to capital where it is most available. I guess what I'm saying is that they have a diversified client base.

Coca-Cola, KO, has been the one rock star in my portfolio. It is the only stock in my portfolio that has ALMOST absorbed my broker's commission and shrugged off the market dips. I added KO because, well, it's KO. They sell sugar water for a big markup. What's to dislike? I certainly don't dislike their future dividend growth.

And, finally, AT&T, aka T. I am not an AT&T customer. Other than landlines, I never have been an AT&T customer. However, they pay good dividends and, in my estimation, have the best prospects for the long term. For example, they will provide broadband to GM cars and trucks. They have hotspots across the country. They provide Internet to Amazon devices. They bundle their offerings for great savings. So, despite their higher cost and meh offerings, they operate a great business. This is probably the only business that I don't like as a consumer; but, love as an owner.

So, that's where my money went.

In the future, I'm looking at a combination of blue chip stocks and those that pay monthly dividends. You may have figured out that capital gains aren't my main concern. I'm looking to play with house money rather than my own money. For this reason, stocks that pay dividends are my preference, with GLD being the only exception.

So, I've slowly been turning my rolled over money into stock positions. The funny thing is that we have been expecting a market correction. So, I decided to slowly put my money into positions rather than all at once. Of course, as soon as most of my money is alloted, the market takes a crap.

I have positions in BBL, BP, DEM, GLD, HCN, HSBC, KO, RIG, and T in the IRA. I bought most of that in the past couple months as the market was reaching its peaks. Sensing that a market correction is imminent, I added GLD to my portfolio so that I don't freak out so much. It has indeed gone up on days that the market takes a dive. However, GLD has overall gone down slowly as the market gently descends.

In other words, I find that GLD is great for market freakouts; but, it's not doing so hot when the market slowly declines. In any case, GLD is in the green today, but in the red overall. Still, it brings me peace in these troubled times.

Today, I allocated the last of my retirement money into RIG, which has had their ass handed to them. As it kept dipping, I kept getting more and more excited. Sure, oil prices are low and production is still working hard. But, it's not like an oil company is going to stop exploring all of the sudden. They may not start new wells. But, they definitely won't stop midway and come back to it later. So, I figure, RIG is a great buy, long-term. I'm down over 10 percent since my first purchase. So, I bought more.

I wish I had more money to put into BBL, another stock that having its day of reckoning. They are down more than 12 percent since my purchase. Ouch. BBL is one of the better mining companies around. If I could afford more, I'd buy it now for the fat dividends in the long-run.

I bought BP because they are a good company that is having government issues. Despite the leeches, they have been making a profit and paying dividends. I think once they are done with the legal stuff, they will be more profitable. So, for me, they have been a depressed stock that will pay off long-term.

DEM invests in dividend paying companies in emerging markets. I know that the fund is somewhat risky; but, only developing markets have the growth potential to ...yes, I'll say it again, pay fat dividends. Imagine the dividend growth rate for 20+ years from now when I am forced to cash out.

HCN was a tough call. I like REITS. I know that healthcare will be a giant industry as baby boomers start to become decrepit. My Edward Jones advisor suggested HCN, and I checked them out, liked the dividends. They actually hold their value well when the market takes a crap. I think investors sell the growth stocks and pile into value, which helps HCN go up while the rest are going down. I think HCN will also help me avoid future freakouts. In the future, however, as my contributions allow, I will probably add O to my portfolio. O is a REIT that pays monthly. I certainly support a stock with that degree of confidence.

I bought HSBC purely for exposure to the financial sector. HSBC has been crawling out of their troubles and may finally be able to put their bad history behind them. More importantly, HSBC is an international concern, which means that they have better access to capital where it is most available. I guess what I'm saying is that they have a diversified client base.

Coca-Cola, KO, has been the one rock star in my portfolio. It is the only stock in my portfolio that has ALMOST absorbed my broker's commission and shrugged off the market dips. I added KO because, well, it's KO. They sell sugar water for a big markup. What's to dislike? I certainly don't dislike their future dividend growth.

And, finally, AT&T, aka T. I am not an AT&T customer. Other than landlines, I never have been an AT&T customer. However, they pay good dividends and, in my estimation, have the best prospects for the long term. For example, they will provide broadband to GM cars and trucks. They have hotspots across the country. They provide Internet to Amazon devices. They bundle their offerings for great savings. So, despite their higher cost and meh offerings, they operate a great business. This is probably the only business that I don't like as a consumer; but, love as an owner.

So, that's where my money went.

In the future, I'm looking at a combination of blue chip stocks and those that pay monthly dividends. You may have figured out that capital gains aren't my main concern. I'm looking to play with house money rather than my own money. For this reason, stocks that pay dividends are my preference, with GLD being the only exception.

Sunday, October 05, 2014

Trying Out Cryptocurrencies

Lately, I have been dedicating a little bit of spare time towards learning about cryptocurrencies such as Bitcoin, Litecoin, Dogecoin, and others. On the surface, there isn't much difference between these newer coins and good old-fashioned Linden dollars from +Second Life. Once you read into the currencies more, however, there are some significant differences, which don't seem of much use at the moment.

I first got interested when I heard that Circle.com had opened up to the public. Signing up was much easier than opening a bank account, that's for certain. Rather than dive in with guns blazing, I decided to get started with just $20. My mistake was attempting to use my debit card to deposit. My first try was flat out declined. My second attempt a few days later contemplated depositing, but ultimately rejected the deposit. On my third try, I used a bank draft instead. That seemed to work just fine.

Customer service at Circle was a little lame. They just give you generic responses, nothing specific. I think they could do better in their goal of making Bitcoin easy for the general public. I think the danger with Circle is that they may have simplified it too much. I can't find my addresses anywhere. I think, perhaps, they propose that you use a new address for every transaction.

I also got a +Coinbase account. Coinbase was straightforward in informing me that they were going to take a few days to make my money available. So, I'm waiting a few days for those coins to become available. Overall, the website seems straightforward. I like that I can find my Bitcoin addresses easily in the interface.

There is one service that I really liked, +Coinkite. What I think is really cool about Coinkite is that they also offer a processing terminal similar to credit card terminals. This machine allows you to make sales and/or operate as an exchange agent. It spits out printed Bitcoin in QR codes. I forgot to mention that Coinkite also works with Litecoin, the up and coming competitor.

Something else I really like about Coinkite is that they round out their processing terminal with a debit card. Of course, you can't use the debit card at a regular ATM. You must use it with the Coinkite terminal. However, in the greater likelihood that you will not have a terminal or computer nearby, your Bitcoin address is printed on the card in numbers and as a QR code. This makes it easier for you to process transactions on the go.

My urgency in buying Bitcoin was so that I could transfer money into my Coinkite account to order a debit card.

I have no illusions that I will be able to go anywhere and buy things with Bitcoin or Litecoin. I think it is still a bit too geeky and the price is too volatile. I think that for Bitcoin or Litecoin to become more accepted, they need the network effect in place. That is to say, you need to know that there are a reliable number of people who will pay you in cryptocurrency and whom you can pay in cryptocurrency.

I recognize that there are other features that cryptocurrency provides that make it a powerful service; but, none of the websites that I've visited thus far use those features. They mainly focus on trading. You have to be a developer geek to take advantage of those extra features, it seems.

In the meantime, I'm waiting for some of my deposits to clear and for my Coinkite debit card to arrive so that I can carry it in my wallet. In the meantime, I will be looking for places that accept Bitcoin. And I suppose I will post my Bitcoin and Litecoin addresses up on my profiles for potential payments. Maybe someday somebody will surprise me and offer to pay in Bitcoin.

I first got interested when I heard that Circle.com had opened up to the public. Signing up was much easier than opening a bank account, that's for certain. Rather than dive in with guns blazing, I decided to get started with just $20. My mistake was attempting to use my debit card to deposit. My first try was flat out declined. My second attempt a few days later contemplated depositing, but ultimately rejected the deposit. On my third try, I used a bank draft instead. That seemed to work just fine.

Customer service at Circle was a little lame. They just give you generic responses, nothing specific. I think they could do better in their goal of making Bitcoin easy for the general public. I think the danger with Circle is that they may have simplified it too much. I can't find my addresses anywhere. I think, perhaps, they propose that you use a new address for every transaction.

I also got a +Coinbase account. Coinbase was straightforward in informing me that they were going to take a few days to make my money available. So, I'm waiting a few days for those coins to become available. Overall, the website seems straightforward. I like that I can find my Bitcoin addresses easily in the interface.

There is one service that I really liked, +Coinkite. What I think is really cool about Coinkite is that they also offer a processing terminal similar to credit card terminals. This machine allows you to make sales and/or operate as an exchange agent. It spits out printed Bitcoin in QR codes. I forgot to mention that Coinkite also works with Litecoin, the up and coming competitor.

Something else I really like about Coinkite is that they round out their processing terminal with a debit card. Of course, you can't use the debit card at a regular ATM. You must use it with the Coinkite terminal. However, in the greater likelihood that you will not have a terminal or computer nearby, your Bitcoin address is printed on the card in numbers and as a QR code. This makes it easier for you to process transactions on the go.

My urgency in buying Bitcoin was so that I could transfer money into my Coinkite account to order a debit card.

I have no illusions that I will be able to go anywhere and buy things with Bitcoin or Litecoin. I think it is still a bit too geeky and the price is too volatile. I think that for Bitcoin or Litecoin to become more accepted, they need the network effect in place. That is to say, you need to know that there are a reliable number of people who will pay you in cryptocurrency and whom you can pay in cryptocurrency.

I recognize that there are other features that cryptocurrency provides that make it a powerful service; but, none of the websites that I've visited thus far use those features. They mainly focus on trading. You have to be a developer geek to take advantage of those extra features, it seems.

In the meantime, I'm waiting for some of my deposits to clear and for my Coinkite debit card to arrive so that I can carry it in my wallet. In the meantime, I will be looking for places that accept Bitcoin. And I suppose I will post my Bitcoin and Litecoin addresses up on my profiles for potential payments. Maybe someday somebody will surprise me and offer to pay in Bitcoin.

Subscribe to:

Posts (Atom)